Risk is Money - The Restaking Legos

In this article, we aim to share a data overview of Ethereum’s staking and restaking landscape; and discuss a metrics framework that can quantitatively measure or alert the restaking market risks.

Effective governance is crucial to guaranteeing the sustainability, security, and flexibility of any given blockchain in response to evolving conditions both within the crypto landscape and beyond. This post examines different governance models within the blockchain space, investigating the decision-making process and the impact of each model on the blockchain ecosystem.

The target audience for this blog post is Ethereum network participants who have a general understanding of Ethereum’s Proof-of-Stake transition, and have interacted with ETH staking, liquid staking, or restaking protocols.

Acronyms:

- Proof-of-Work (PoW)

- Proof-of-Stake (PoS)

- Liquid Staking Tokens (LSTs)

- Liquid Restaking Tokens (LRTs)

- Actively Validated Services (AVS)

- Decentralized Finance (DeFi)

- Total Value Locked (TVL)

Liquid Staking Economy

Post-Merge in September 2022, Ethereum’s consensus layer transitioned from PoW to PoS. While now everyone can stake 32 ETH and validate Ethereum blocks using their home devices, solo staking comes with the risk of inactive penalties and slashing - when a node goes offline for extended period or misbehaves, a certain amount of staked ETH will be deducted as penalty depending on the severity.

With a foresight into reducing entry barriers and operational overheads, Lido, a liquid staking protocol, was launched shortly after ETH staking became possible with the Beacon Chain's launch in December 2020. Liquid staking protocols allow individuals to stake less than 32 ETH and earn rewards, at around 3% APY, without managing nodes themselves. Instead, the operation is outsourced to a set of whitelisted operators who run the nodes and distribute block proposals and attestation rewards to users. Around the same time, institutions like Binance, Coinbase, and ConsenSys also quickly began to offer custodial ETH staking services with approximately 3~4% APY.

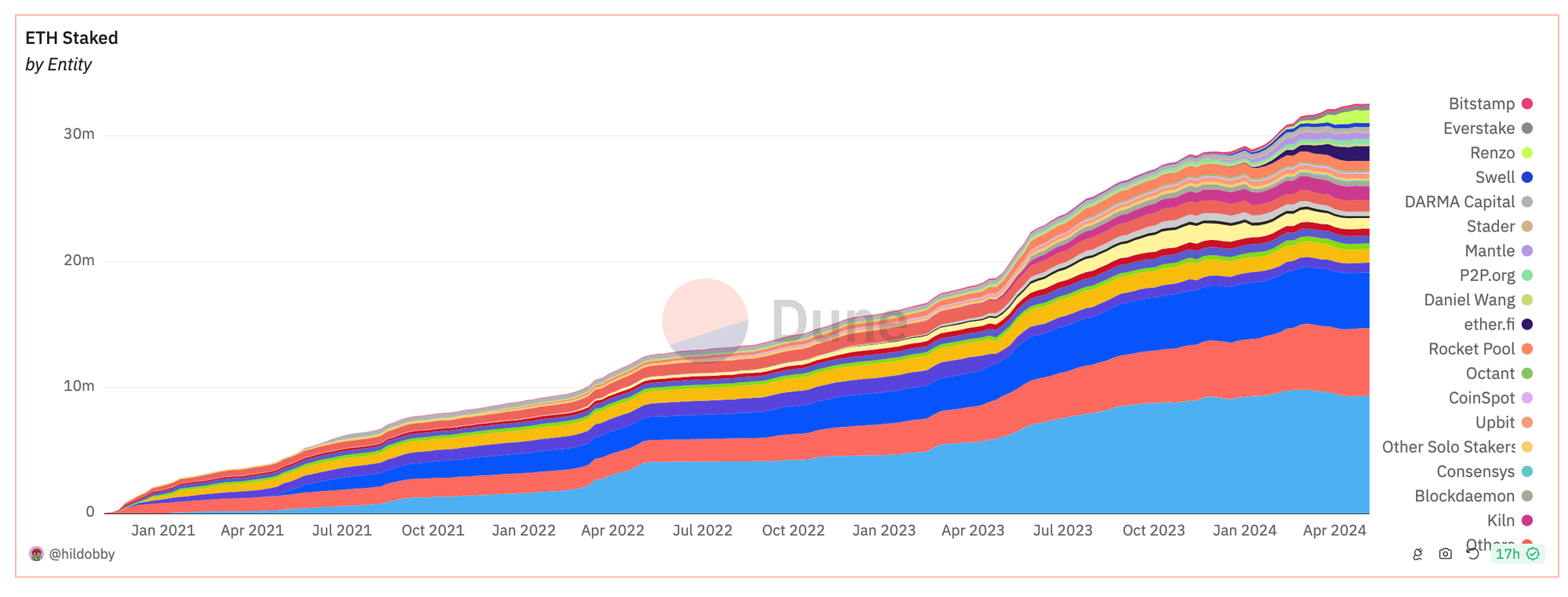

Over the past three years, the staking landscape has seen substantial growth. As of today, over $125 billion (~33m ETH, approximately one-quarter of the total ETH supply) is staked, with leading protocols such as Lido accounting for ~30% of the network stakes.

Furthermore, when users stake native ETH assets into staking protocols and services, they receive Liquid Staking Tokens (LSTs) in return—such as stETH (Lido ETH), rETH (Rocket Pool ETH), and cbETH (Coinbase ETH). These tokens enable users to leverage their economic value further by trading, staking, or lending on DeFi markets.

Liquid staking protocols have increased the capital efficiency of ETH assets staked in the Beacon Chain, enabling users to utilize liquid assets while earning staking rewards from the consensus layer. However, these protocols also introduce a layer of risks. For example, if any operator is slashed and Lido loses its staked ETH, users will share the loss through a reduced redemption rate. Additionally, LSTs, as an asset class, carry their own economic risks when traded on the market, particularly the risk of losing their peg to ETH during market panic events.

The Idea of Restaking by EigenLayer

In 2023, EigenLayer proposed a scalability and security framework built on Ethereum that leverages existing staked ETH to secure additional layers and protocols. The protocols that can be secured are called AVS, which includes a variety of use cases: Oracles, Layer 2s with decentralized sequencers, Data Indexing services, DeFi protocols, and Gaming.

There are a few key roles in the EigenLayer’s ecosystem:

|

|

Users

|

Operators

|

AVS

|

EigenLayer Protocol

|

|---|---|---|---|---|

|

Roles

|

Depositors and Delegators

|

Node Operators

|

Secured Protocols and Services

|

Framework and Coordinator

|

|

Functions

|

- ETH stakers

- Restake ETH & LSTs into Eigenlayer

- Delegate restaked value to operators

- Receive rewards from AVS validated by the operator

|

- ETH validators who applied and got approved by EigenLayer

- Receive delegated restaking value from usersr

- Also validate network for AVS

|

- Services that registered and got approved by EigenLayer

- Issue rewards towards operators who validate the network

|

- Manages collateral asset & AVS listing

- Holds LSTs in contracts and staked ETH (EigenPod)

|

|

Incentives

|

Restaked points

|

AVS rewards

|

Shared security with Ethereum consensus

|

No fee implementation announced yet.

|

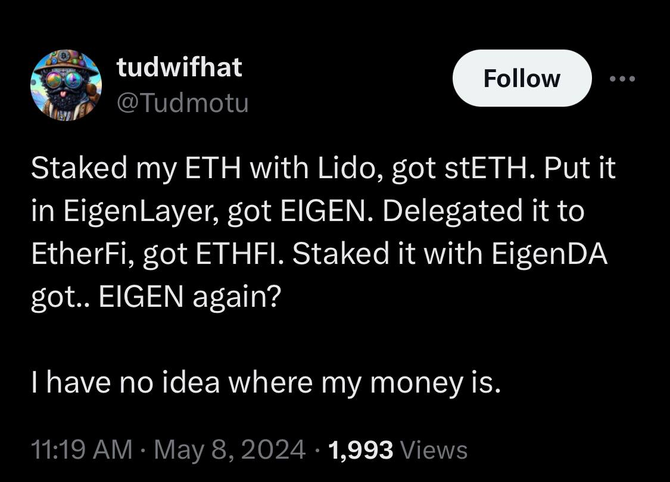

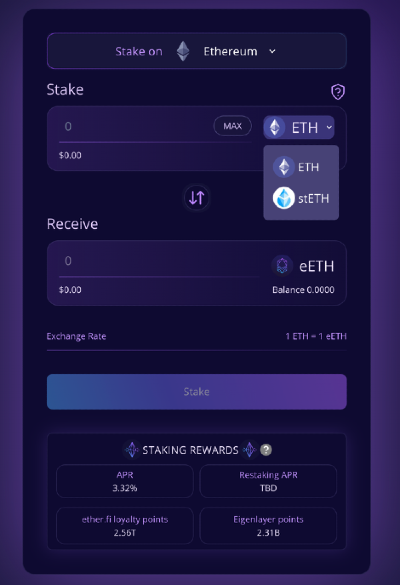

A number of restaking protocols emerged on top of the EigenLayer ecosystem, serving as a proxy layer for users to participate in the EigenLayer restaking. As an example in the screenshot below, instead of depositing on EigenLayer website then delegate the value to ether.fi, users can also stake their ETH or stETH directly into ether.fi protocol on their website, get eETH back as the Liquid Restaking Token (LRT). Ether.fi as a registered Operator on EigenLayer, then will deposit the value into EigenLayer and validate nodes for AVS.

Compared to depositing directly on EigenLayer and delegate, ether.fi users earn not only staking rewards and EigenLayer points but also extra ether.fi points and hold a liquid restaking token eETH for use at DeFi markets.

Currently, there are ~290 AVS and ~1425 Operators registered. More detailed information about each entities can be found from community dashboard.

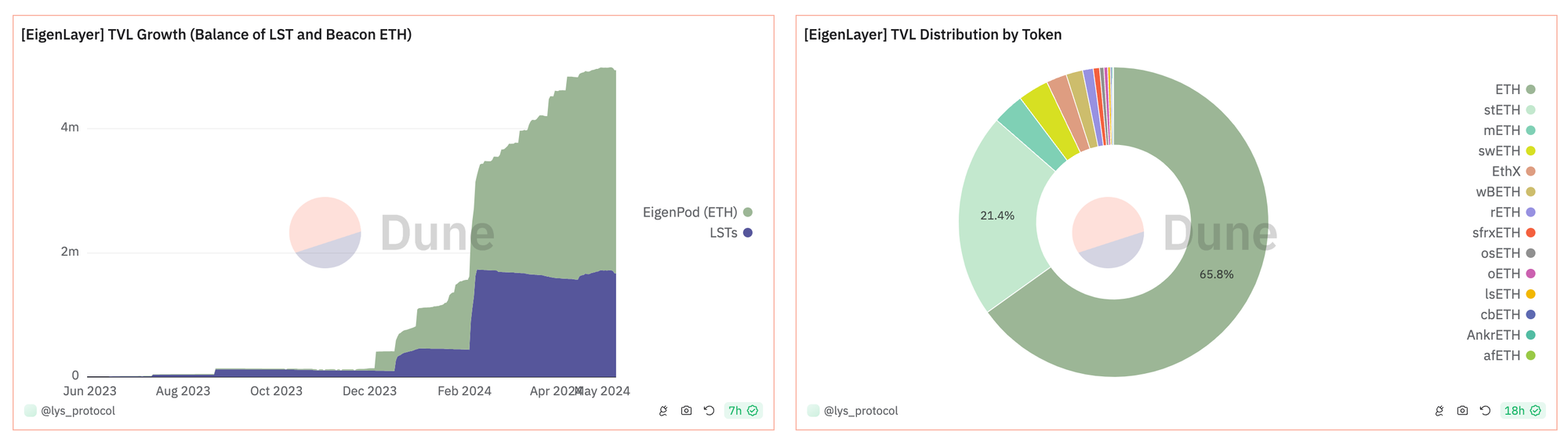

EigenLayer’s TVL escalated drastically in Feb 2024 and surpassed AAVE on March 5th, which is the largest DeFi protocol by TVL (~$10b). By May 23rd, EigenLayer is now the 2nd largest protocol by TVL next to Lido, with total value deposited rounding up to ~$19b (~5m ETH). Of all the deposited assets, ~66% are native ETH staked by validators who have set their withdrawal addresses to EigenPod. The largest portion of the remaining assets is stETH (Lido ETH), accounting for ~21.4% of the total EigenLayer collateral pool, followed by mETH and swETH.

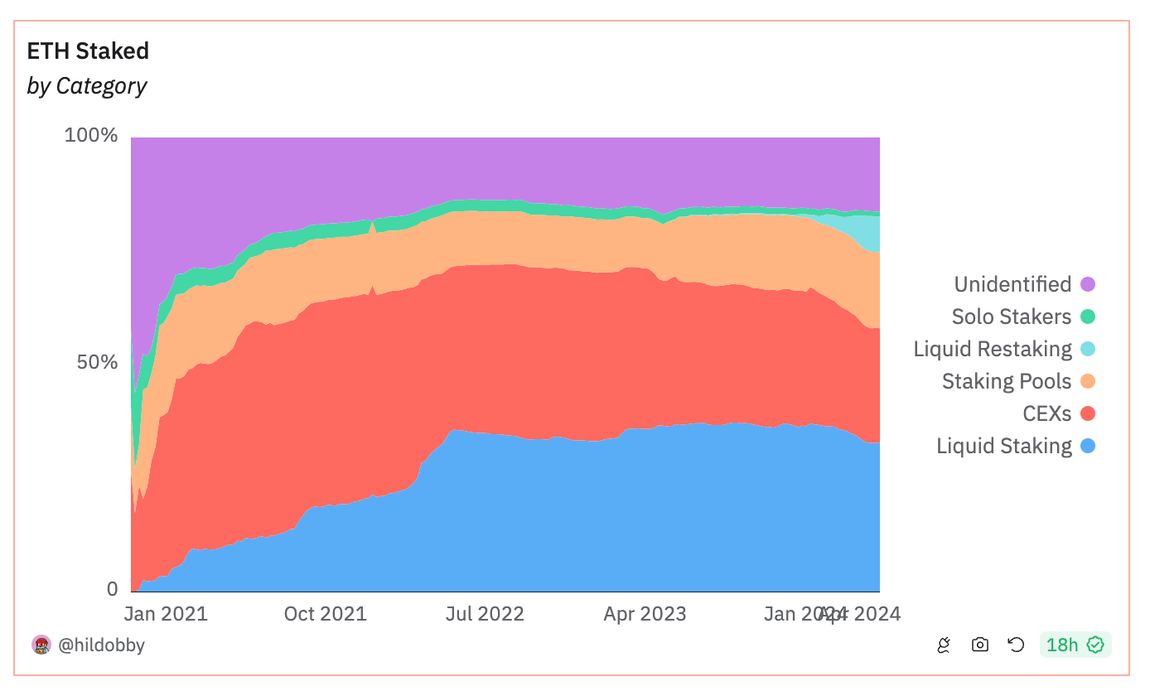

EigenLayer has shifted the paradigm of the staking economy. The chart below illustrates how EigenLayer’s growth timeline correlates with movements of staked ETH across different protocol categories: Starting from early this year, restaking protocols have absorbed ETH from both centralized exchanges and liquid staking protocols. Over the past year, the share of ETH staked through centralized exchanges' liquid staking offerings has decreased from ~38% to 25% today, while ~8% of ETH is now directly staked into newly emerged liquid restaking protocols since January 2024.

It is important to note that EigenLayer has consistently monitored and capped the amount of LSTs accepted by the protocols at various phases due to their risk profiles. To deposit into EigenLayer when the LST caps are reached, users often need to unstake their ETH from liquid or custodial staking services and stake native ETH directly into EigenPod.

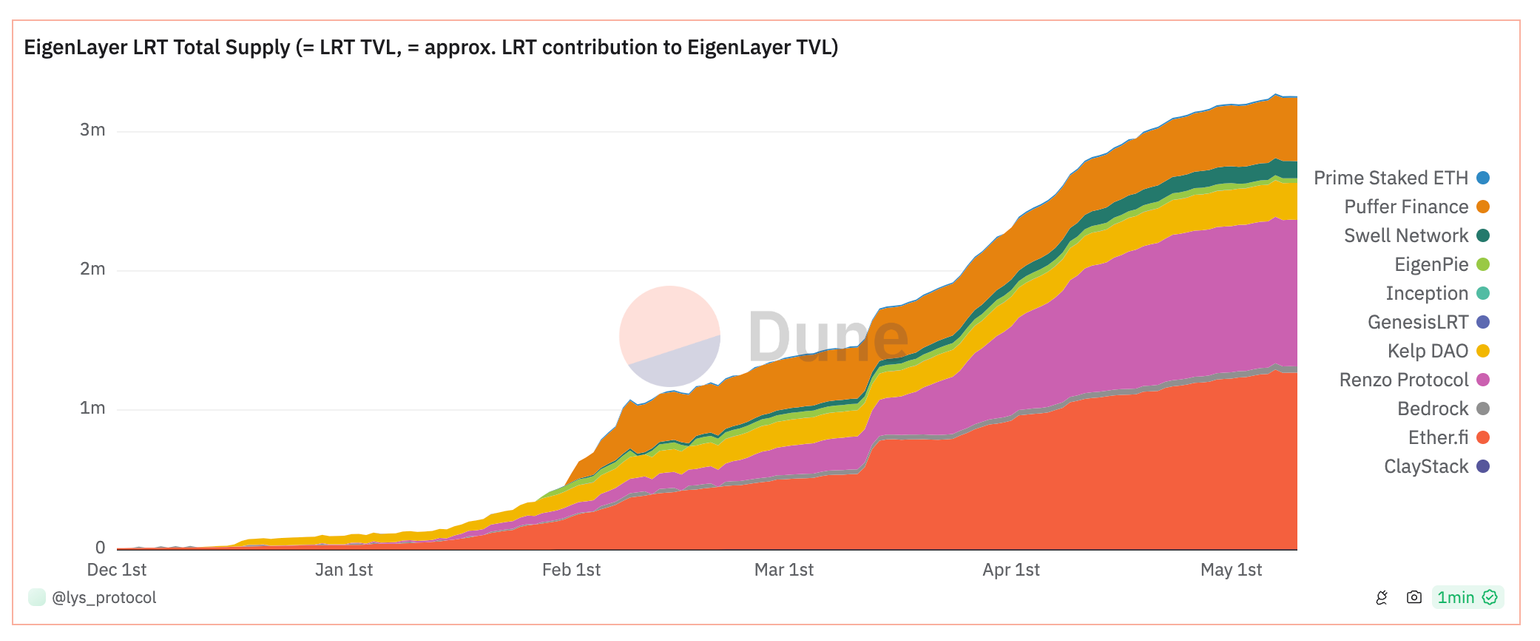

When looking into the depositing entities into EigenLayer, it is observed that the combined deposits from all the Restaking protocols accumulate to approximately 3.3 million ETH. Compared with EigenLayer’s total TVL of 5m ETH, we conclude that the remaining ~1.7m ETH are deposited by individual users directly through the EigenLayer interface.

A breakdown of the EigenLayer Ecosystem shows that ether.fi contributed ~25% (~1.27m ETH) of the total TVL, followed by Renzo with ~21% (~1.05m ETH). The next largest restaking protocols are Puffer Finance, Kelp DAO, and Swell Network.

Risk is Money

Comparison: Staking, Liquid Staking (LSTs), Liquid Restaking (LRTs)

The emergence of liquid staking and restaking mechanisms provides participants with flexible liquidity options and additional earning opportunities while introducing new risk layers. To summarize, here is a comparison between all these staking flywheels mentioned above:

|

Category

|

In-protocol Staking

|

Liquid Staking

|

Liquid Restaking

|

|

Definition

|

Stake native ETH into the beacon chain (consensus layer) to validate the Ethereum network and earn staking rewards.

|

Deposit native ETH and earn staking rewards, get LSTs in return to use in DeFi.

|

Deposit native ETH or LSTs and earn staking rewards, restaking protocols and EigenLayer AVS rewards, get LRTs in return to use in DeFi.

|

|

Main Purpose

|

Network security and rewards.

|

Liquidity for staked ETH, with rewards.

|

Shard ETH security towards more services, with liquidity in form of LRTs.

|

|

Risk Profile

|

slashing, volatility risks.

|

slashing, smart contract, depegging, governance risks.

|

slashing, smart contract, depegging, governance risks from both staking and restaking protocols; DeFi composability risks.

|

|

Example

|

Solo Stakers

|

Lido, Rocket Pool, Frax Ether, Coinbase Staking

|

Renzo, Kelp DAO, Puffer Finance, Swell

|

As we explained above, the Liquid Staking protocols introduced risks for users when their operators get slashed or LSTs gets depegged. Similarly, an extra layer of risk is introduced by the restaking protocols: EigenLayer operators may encounter penalties and slashing from AVS and lose economic value at stake. Beyond, there are a lot more economic risks to be discussed now with this complex system. While lots of the modules (withdrawal, slashing) in restaking protocols are not yet live or have only pre-mature empirical data, we want to highlight a few data metrics that can alert the risk implications across the stack.

Smart Contract Risk from Restaking Protocols

Intuitively, as the restaking protocols are handling deposited assets before they stake them into EigenLayer, there are smart contract risks of being exploited and funds being drained. Similarly for the EigenLayer strategies contracts holding the LSTs tokens, contracts risks exist.

Besides the code vulnerabilities themselves, oracle and governance contracts can also be manipulated.

As of now, there aren’t many details on how EigenLayer conducts the due diligence process for accepted collateral, operators, and AVS. In a future with EigenLayer protocol being decentralized, these process can create risks of manipulation - a malicious operator or AVS can largely damage the network stability and cause cascading shock events.

LRT Economic Risk from Leverage, Market Shock and “Depegging”

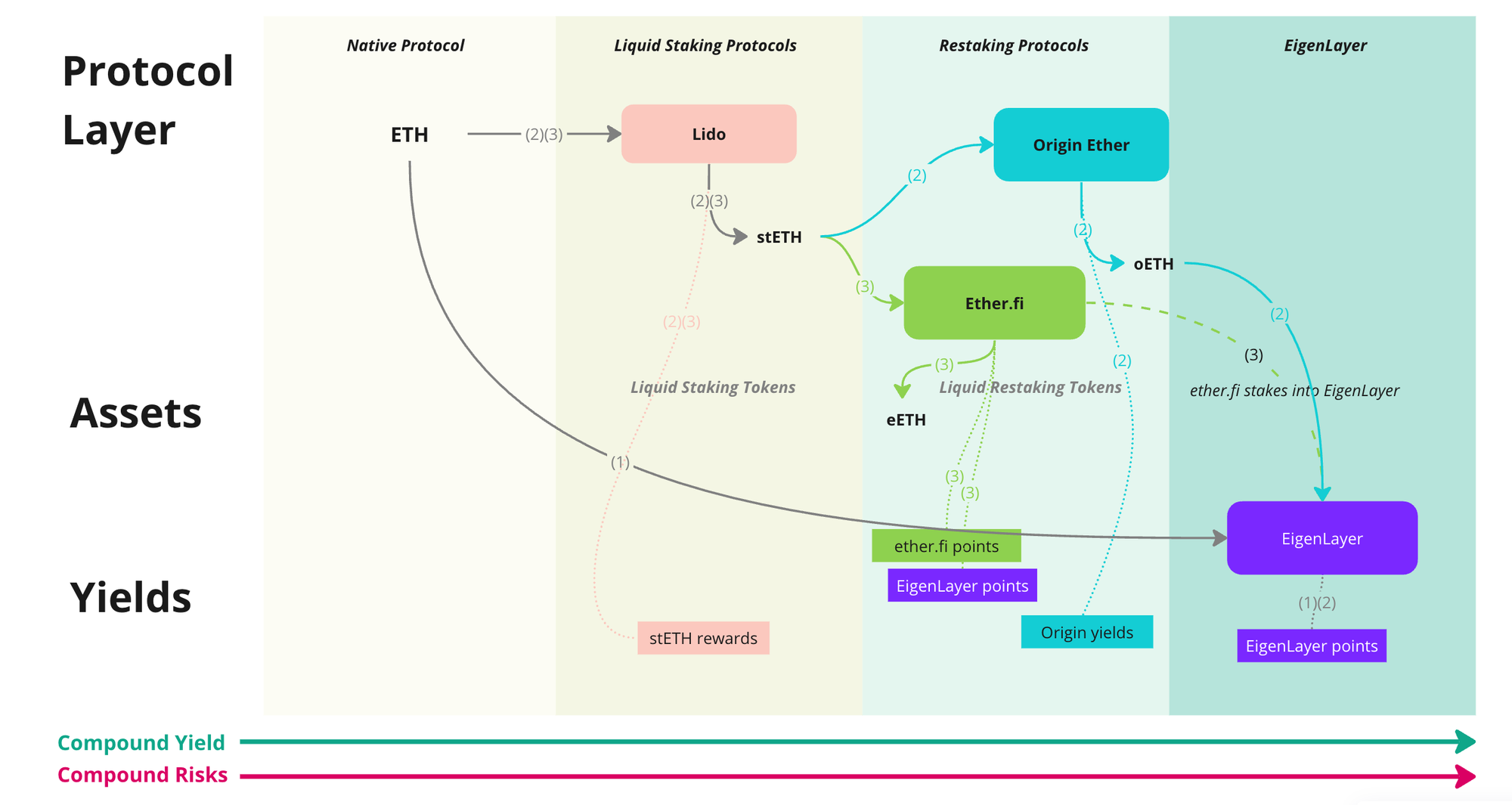

So, what does the workflow look like? To elaborate on the dynamics of the restaking landscape, we created a diagram to showcase the flow of assets below.

From the left to the right, the native asset (ETH) is being staked into multiple layers and bearing multiple layers of rewards. Users can participate in EigenLayer restaking in 3 ways:

(1) Stake native ETH: existing ETH stakers can change their withdraw address of the 32 staked ETH to EigenPod, and earn rewards after they delegate the staked amount to EigenLayer operators who run validators for AVS; they can also be a operator and secure AVS.

(2) Staking LSTs directly to EigenLayer: for users who staked ETH into the staking protocols, they can deposit their LSTs (e.g. stETH, rETH, frxETH) into EigenLayer and delegate the economic value to operators; in this case, on the same amount of ETH collateral, they are earning EigenLayer points while continue earning yields from staking protocols.

As highlighted in the path (2), different from all other LSTs, one particular asset EigenLayer accepts is Origin ETH (oETH) - which itself is a restaked protocol asset, accepting collateral of stETH, ETH, WETH, rETH, frxETH. This means the security guarantee tied to ETH consensus, brought by this collateral is diluted due to its layers of induced risks.

(3) Stake through Liquid Restaking Protocols: Users can also deposit ETH or LSTs into restaking protocols, who then will deposit into EigenLayer and delegate to operators who run AVS validations. Users earn staking rewards from the LST or ETH staking layer, and also collect EigenLayer points, with extra Restaking protocols (e.g ether.fi, Renzo) issued rewards. Besides the rewards, users are also issued with LRTs which allow them to trade or lend it for liquid assets on the markets.

As highlighted in path (3), a user who deposits Lido ETH into Ether.fi will earn stETH yields, ether.fi points and EigenLayer points, as well as hold eETH as liquid assets.

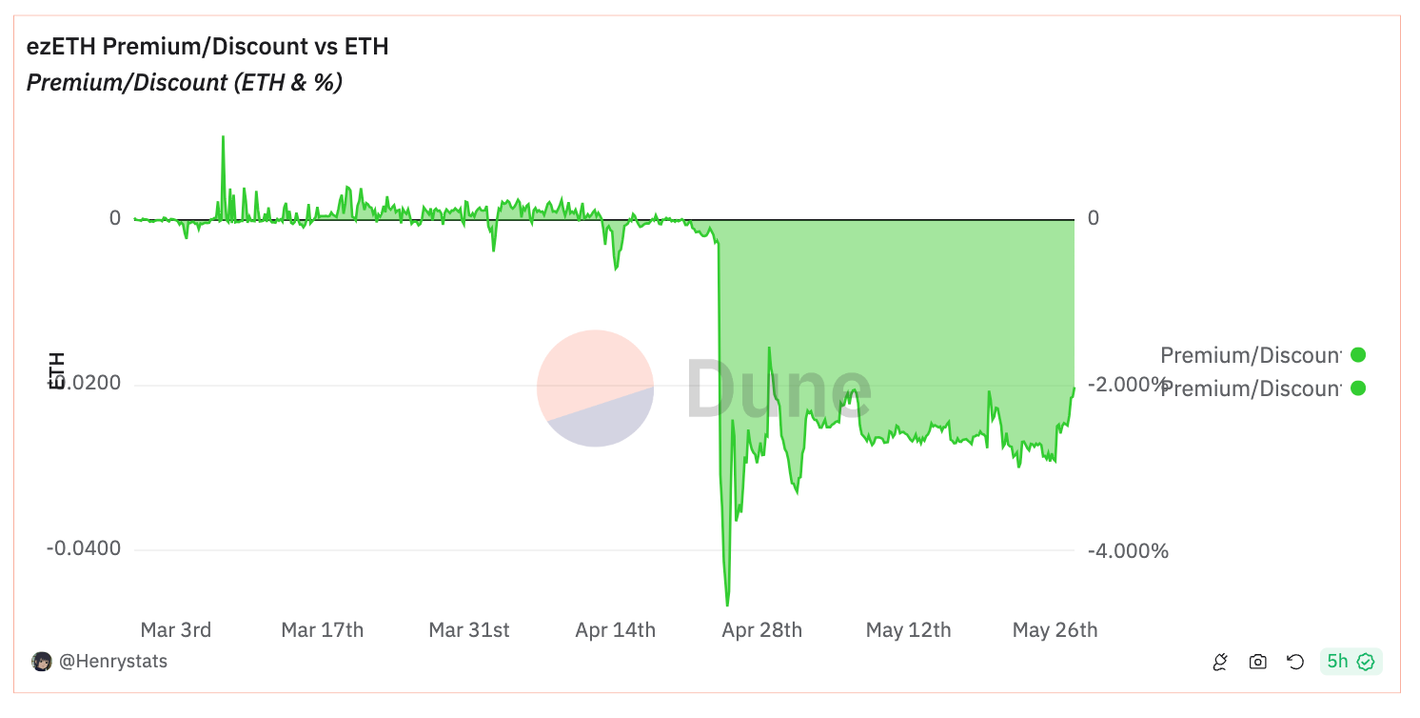

To maximize the yield earning, we can see how a holding of native ETH can be multiplied by at most 3 layers of rewards. Clearly, the compounding yields carry the compounding risks from each layer of the protocols. Here comes the “evil” play: one can trade their LRTs asset into ETH or LSTs, and deposit into the restaking protocol again for more LRTs, and leverage it in loops. This loop will inflate the TVL of restaking protocols by large amount, as well as cause depegging in the market ratio. Of course, this will create arbitrage opportunities, and the market will balance out as we’ve seen with the recent events of LRT’s depegging (eg. the Renzo incident).

Market Exchange Rate

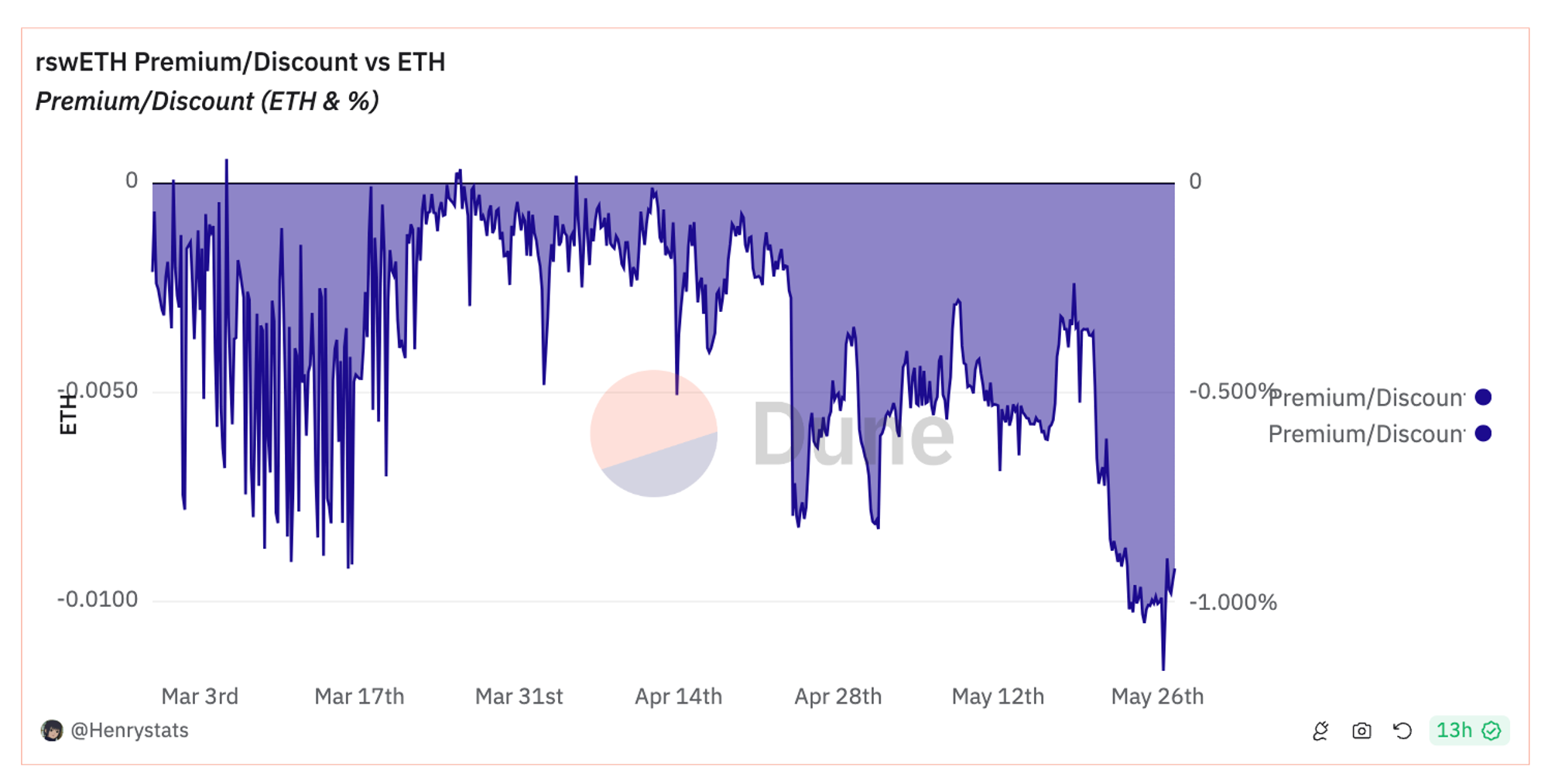

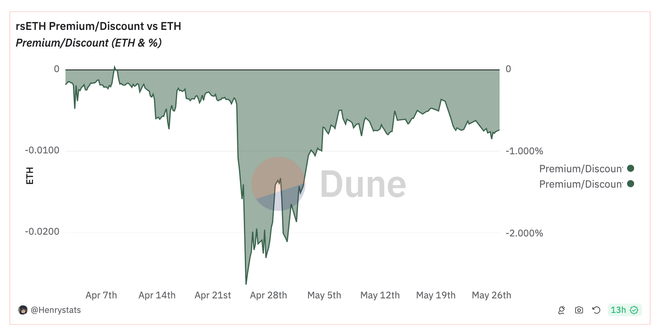

When an asset has large discount on the market exchange rate, compared to their oracle price, this might indicate that people are selling the assets with high volume. Hence the discount, or the price deviation can flag the devaluation.

Another indicator is how fast the asset’s price are bounced back to its intended price against, the faster would mean there are more circulation and holding interests.

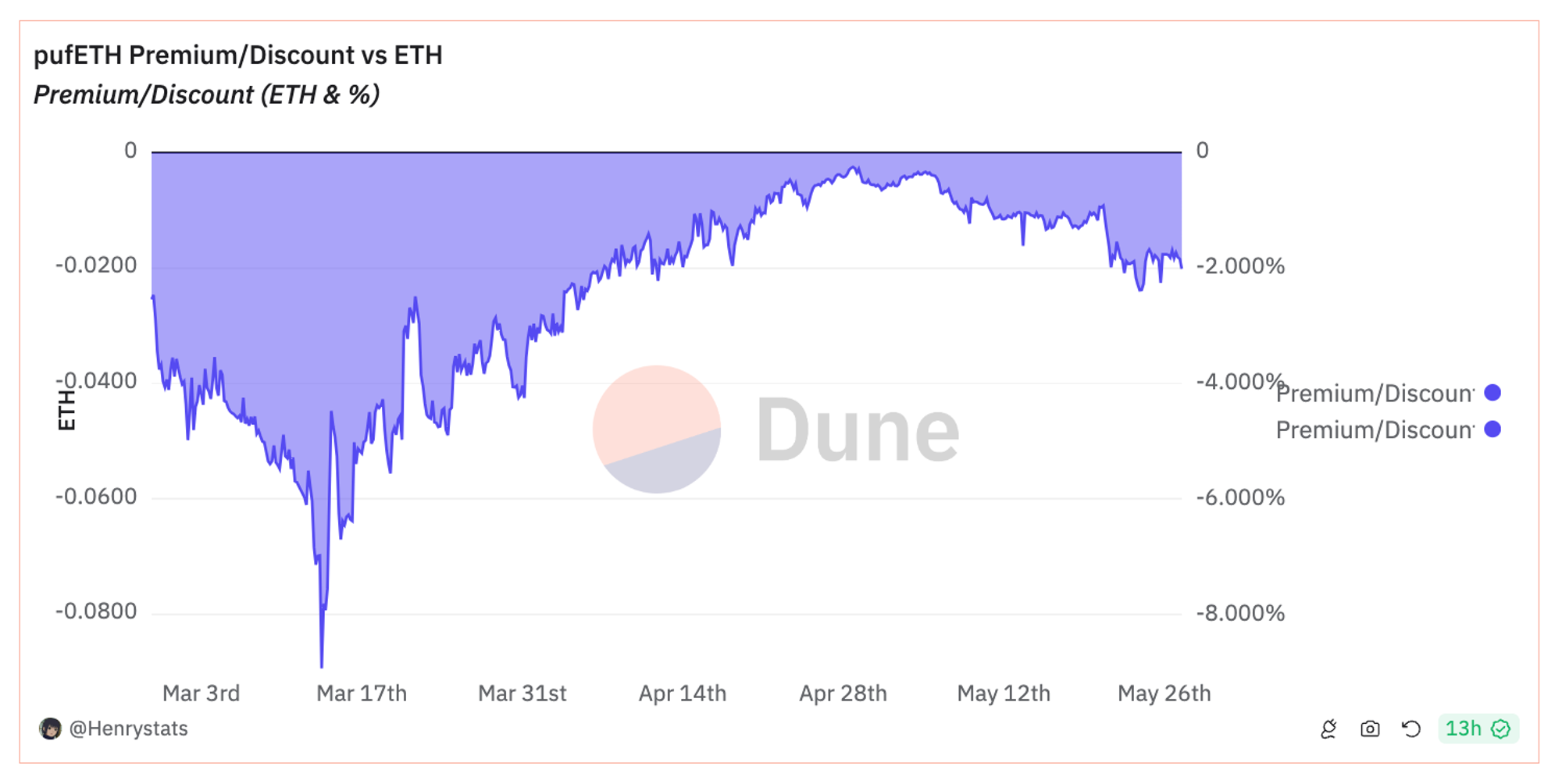

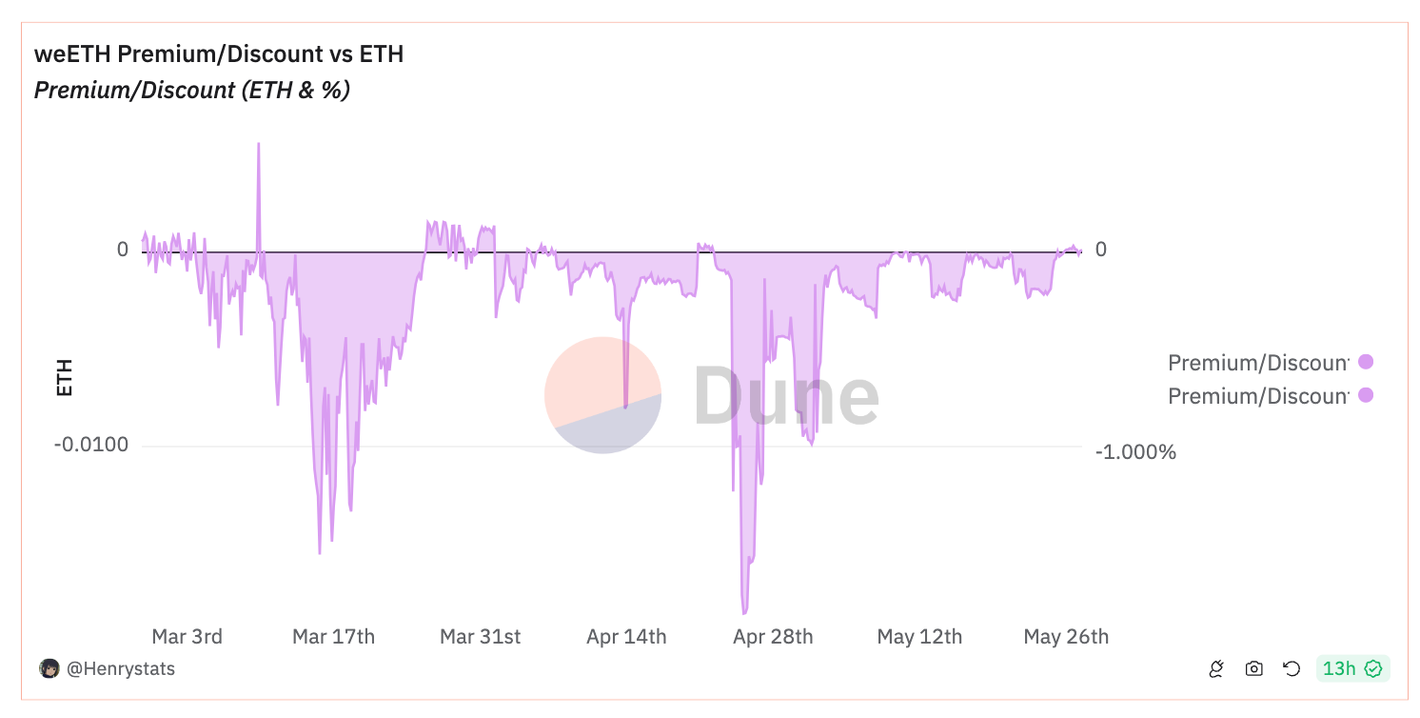

Based on this Dune dashboard, most of the LRTs have already experienced mini “depegging” event, with 2 spikes on March 13th and April 24th. The most severe one is pufETH which was traded on DEXes at -9% discount on March 13th.

Ether.fi appears to be the most healthy asset, as its exchange rate on DEXes quickly bounced back to its peg against ETH.

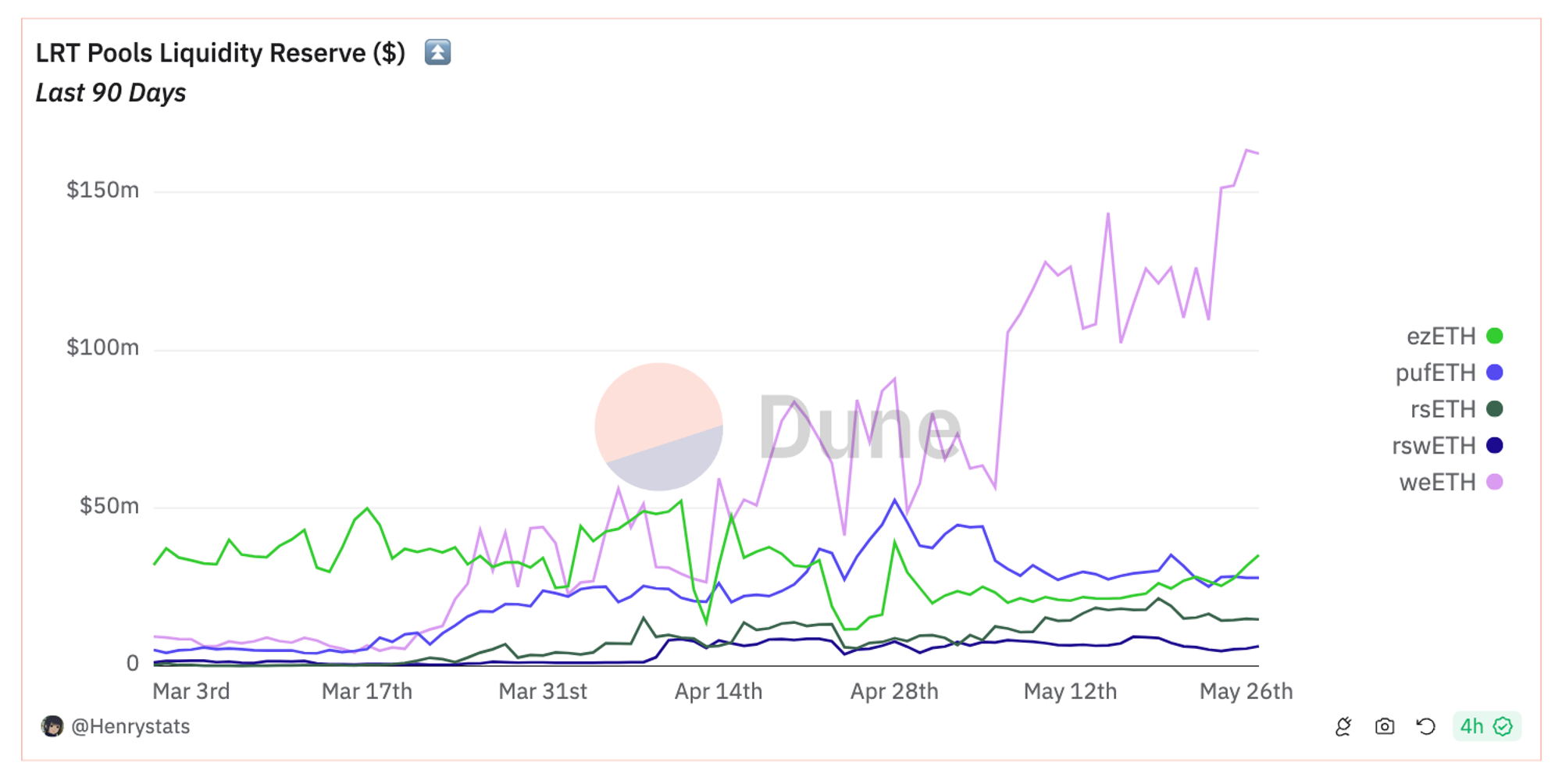

Liquidity Depth

As discussed from this EigenLayer’s post, liquidity depth is another important measure on how healthy LRTs. A direct metric can be the TVL of the LRT pools on AMM DEXes:

Is there a healthy amount of secondary market liquidity for the LRT? From the chart below, we can see that Ether.fi leads the race with over $100m in AMM pools.

The number of withdrawals can be an estimate of market shock. Withdraw pending time is added so to avoid “round trip” transactions for arbitraging MEV, as well as to prevent “bank run” risk in restaking protocol. When users are withdrawing from a restaking protocol, the protocol will have to withdraw its assets from EigenLayer which has 7 days waiting time. In a market shock event, these layers of waiting time will add risks of devaluation of the deposited assets.

Slashing Risk from Malicious AVS and Operator Misbehave

Given the different utility and attributes of the AVS, operators may be required to facilitate lower latency or larger load of data storage. It is not yet clear how thoroughly operators understand the protocol risks associated with each AVS they are actively validating, and therefore, the potential risks of penalties and slashings remain uncertain. A few more questions were raised in this article by Kairos Research.

Further, since lots of the restaking protocols delegate operations to node clients, they are delegating risks to another layer out of their own control. The most straight forward risk here for users is, if the operator goes offline for extended period or misbehave, users may lose their economic value of LSTs staked into the restaking protocols indirectly as a consequence.

Security Risk for AVS: Operator Under-collateralization and Centralization

Under-collateralization: Security Collateral Ratio

Since the underlying security guarantee comes from the ETH staked, the “collateral ratio” between “AVS stake securing” and “ETH value staked” is a crucial measure to monitor. Here, “ETH value staked” is the security collateral, while the “AVS stake securing” can be the value required to run an equivalent number of validators or estimated by the TVL of the services being secured.

In an extreme condition, the risk would be high if a small ETH staker is allowed to validate a large-value AVS network that’s higher than its staked value. This value ratio can fluctuate drastically in a volatile market if the native tokens of secured AVS are not ETH but other tokens.

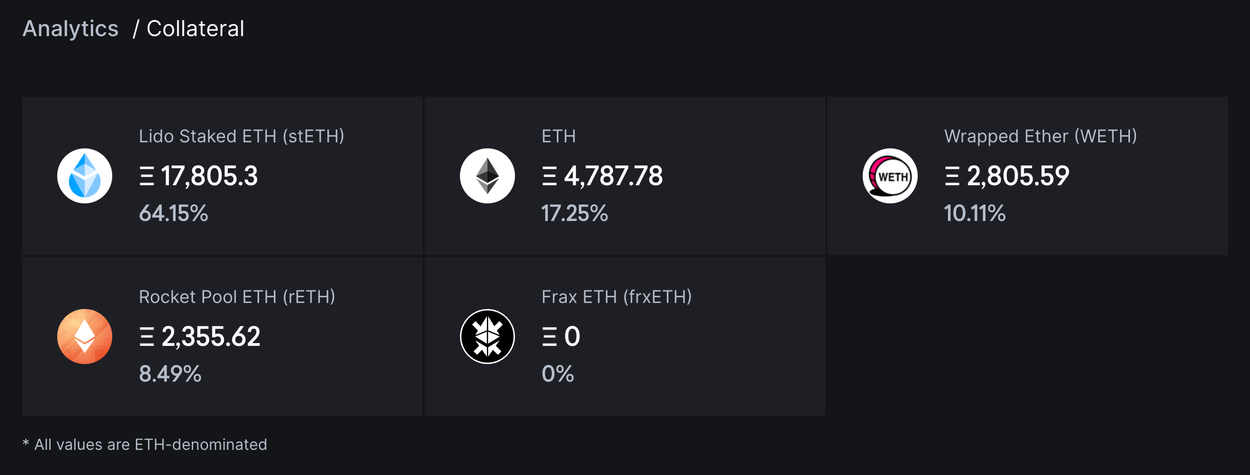

For each Operator, its total delegated value’s collateral breakdown also matters since different types of assets carry different level of risks - for example, a operators with delegated value all from native ETH has a higher asset security, lower economic risk compared to an Operator with 100% delegated value coming from LRTs (e.g oETH) and LSTs (e.g. stETH, fraxETH), which can be traded far below ETH peg.

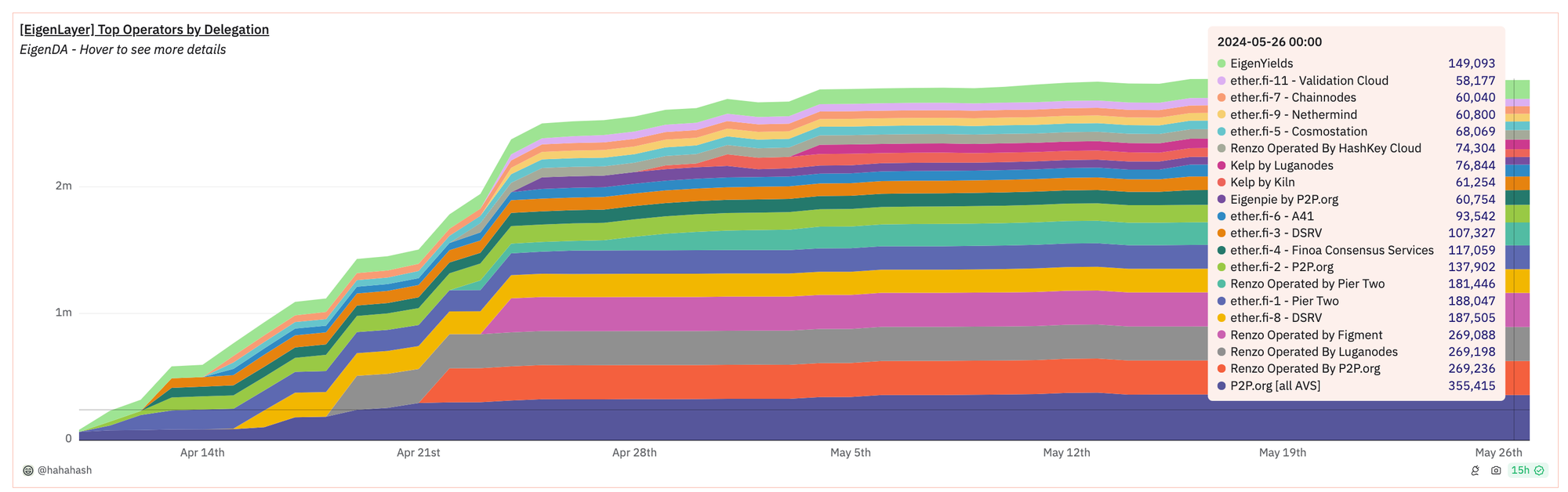

Operator Centralization

As we understand, restaking protocols serve 2 roles in EigenLayer ecosystem: the proxy depositors and also the operators. They are vertically integrated in these 2 roles and hence maximally incentivized to delegate all their user deposits to their own operators.

As of now when examining the top 20 Operators delegated, we can also see the concentration around a few entities including P2P.org, Renzo, ether.fi, Kelp and EigenYields. Since lots of depositors may follow delegating to top operators without their own due diligence, a larger delegation doesn't guarantee better operation quality and infrastructure with reduced risks of slashing. The more centralized the delegation is, the more fragile the system can suffer from a slashing event. Hence, each operator’s delegation capacity and their yield can and should be regulated through economics design, so to ensure a more resilient structure of the network.

Many restaking protocols’ operators, as indicated in the names, are actually run by node client services (e.g., P2P.org, Kiln, Pigment). This adds another layer of complexity and reduces the transparency of how centralized the delegated power is - for example, P2P.org, with over 355k ETH delegated, is the No.1 operator right now. However, the 2nd highest stake Operator, “Renzo, Operated by P2P.org,” increases P2P.org’s network control further to almost 2x! This means P2P.org’s actual control over certain AVS - if both top 2 operators are validating the same AVS - is way higher than each operator's individual control seems. Single-point failure from 1 operator client may now impose a larger risk on the whole EigenLayer ecosystem.

DeFi Composability Risk: The Money Lego

Restaking protocols are seeking to list their Liquid Restaking Tokens (LRTs) on major lending platforms such as AAVE and Compound. Renzo's snapshot proposal on AAVE was successfully approved even before their native withdrawals were implemented. Similarly, Kelp DAO has submitted a proposal on Compound’s forum to list rsETH as collateral, which has received overall positive community sentiment. The integration of LRT assets into lending markets enables users to deposit their LRTs and borrow major assets like ETH and USDC from the platform, potentially allowing them to further leverage these assets in cycles of ETH staking and restaking. Obviously, this introduces additional risks associated with the composability. In a market downfall, when LRT loses its peg towards ETH, users deposits in Lending protocols will be liquidated which could lead to increased sell pressure of LRTs on decentralized exchanges (DEXes), which then further worsens the LRT price drops into cascading spirals during market downturns.

Looking forward

Various studies have shown that there are bank run risks in DeFi innovations:

- For stablecoins, we have seen multiple algorithmic stablecoins went into death spiral after a market shock (Terra-Luna, IRON)

- For lending markets, there also have been near-illiquid events on over-collateral lending platforms.

With restaking beyond the monetary risks arising from the liquidity aspect and collateral assets, slashing and more composability risks come into play.

We believe risk management is crucial to restaking ecosystem, which requires a comprehensive understanding of metrics that can be formalized and monitored with real time data. We encourage community effort to build data on this front and will continue to research on this topic.